About the Service

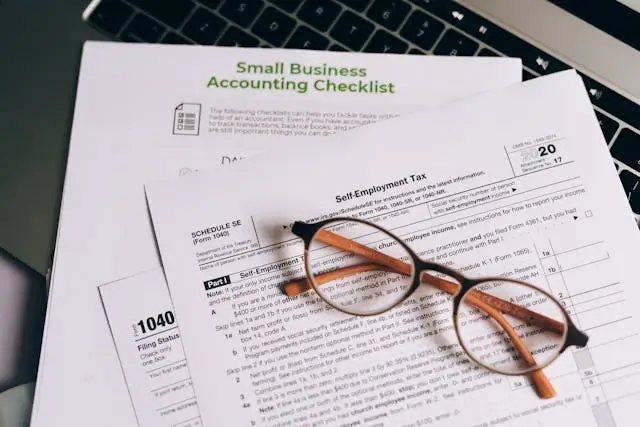

We offer detailed tax compliance verification services, ensuring all financial processes and reports are perfectly aligned with current legislative requirements. Our team constantly monitors legislative changes and proactively implements necessary adjustments in your tax systems. We conduct comprehensive analyses of tax documentation, verify the accuracy of calculations, and ensure the correctness of tax declarations. We identify potential risk areas and provide concrete solutions to address them. Additionally, we offer specific consultancy for optimizing tax reporting processes and implementing best practices in the field. Our service also includes support in dealings with tax authorities and assistance during tax controls or audits.

Benefits

- Tax risk prevention

- Legislative compliance

- Minimization of potential fines

- Optimization of tax strategy

- Reduction of administrative burden

- Providing proactive tax advice

Audit Process

Preliminary Analysis

Initial assessment of tax documentation and identification of potential risk areas.

Document Verification

Detailed examination of tax declarations, accounting records, and other relevant documents.

Compliance Tests

Carrying out specific tests to verify compliance with current tax legislation.

Identification of Discrepancies

In-depth analysis to identify inconsistencies or potential tax risks.

Reporting and Recommendations

Detailed report preparation with findings and actionable recommendations for tax optimization.

Frequently Asked Questions

The service includes verification of tax returns, regulatory compliance, and identification of tax optimization opportunities.

Annual checks or reviews are recommended after significant tax legislation changes.

Benefits include reduced tax risks, optimized payments, and sustained financial compliance.

Ready to Transform Your Finances?

Our team of financial experts is ready to guide you towards success. Take advantage of a free consultation and discover your business's financial potential.